Income tax thresholds will be frozen until 2031 while the two child benefit cap will be scrapped next year under UK Government budget plans that Plaid Cymru have said leaves Wales “being short-changed again.”

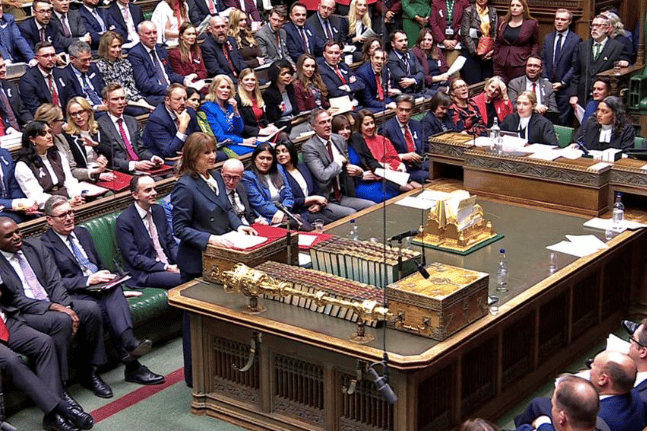

UK Chancellor Rachel Reeves unveiled her budget in the House of Commons on Wednesday, 26 November.

Under her plans, the current £12,570 threshold of income tax and national insurance will remain in place until 2031 – meaning as wages rise more and more of the lowest paid workers in the UK will be taxed on more of their earnings.

The minimum wage will rise, the Chancellor announced, up to £12.71 an hour for workers aged 21 and over, up from £12.21.

The Chancellor also announced electric vehicle and hybrid car drivers will be taxed for using the road for the first time from 2028.

The new charge will be 3p-per-mile, meaning a £210 annual cost for the average driver doing 7,000 miles a year.

A temporary 5p cut to fuel duty for regular cars will be kept for a further five months before increasing from September 2026.

Plans have also been put in place to cut some levies on energy bills, which the Chancellor said will lower bills for millions of households by £150 a year.

In a big announcement, the Chancellor announced that the two-child benefit cap will be lifted from April 2026.

The two-child cap came into effect in April 2017, limiting Universal Credit and Tax Credit to two children.

The Chancellor said the two-child cap had pushed "hundreds of thousands of children into poverty since it was introduced".

In 2029-30 an estimated 560,000 families will see an increase in universal credit averaging £5,310 per year.

The government says this measure will lift 450,000 children out of poverty including 69,000 in Wales.

Removing the cap will cost £2.3bn in 2026-27 and £3bn in 2029-30, according to the Office for Budget Responsibility (OBR).

Funded by tackling welfare fraud and long-overdue reforms to the Motability scheme, the Treasury said the move “will result in the biggest reduction in child poverty at any Budget this century.”

More than 100 charities wrote to the chancellor urging her to scrap the limit.

Taxes on property, dividend and saving income – which currently face no equivalent of National Insurance – will also be increased by 2p.

The State Pension will increase by 4.8 per cent from April.

The OBR said in its report on the budget - inadvertently released on its website around two hours ahead of the Chancellor’s announcement causing a stir in Westminster - that the overall tax increases will bring "the tax take to an all-time high of 38 per cent of GDP in 2030-31".

John O’Connell, chief executive of the TaxPayers' Alliance, said: “The chancellor’s budget benefits bonanza will be paid for by hard working taxpayers through their incomes, pensions, property, savings and beyond.

“Rachel Reeves needs to urgently change course, by drastically reducing the benefits bill, bringing in targeted, growth generating tax cuts and deregulating the economy.

“We are now dangerously close to the cliff edge.”

Segments of the UK Government dealing with devolved issues such as health do not apply to Wales, but the Chancellor announced a boost in funding to Wales as part of the budget which will form the basis of the Welsh Government’s own budget.

Changes to the Welsh Government Fiscal Framework will mean that Welsh Government has an extra £425 million spending power over the next few years.

That additional funding comes from increased borrowing limits and more flexibility in how Wales can manage its budget.

The budget also saw an extra £505 million for the Welsh Government, through the Barnett Formula, on top of the largest settlement for the Welsh Government in the history of devolution.

First Minister Eluned Morgan said the UK budget “will help people right across Wales.”

“It will mean more money in the pocket of people who need it the most, support for energy bills, a raise in the minimum wage and good news for pensioners.

“I’m pleased the Chancellor has listened to our call to scrap the two-child benefits limit, which will help to tackle the scourge of child poverty.

“We called on the UK Government to continue to support us with more money for hard pressed public services and they have delivered with an extra £500m, building on the £5 billion of extra funding they have already confirmed.

“We will also see significant investment in Wales, including in AI Growth Zones, advanced manufacturing, steel transition in Port Talbot, and nuclear energy in Anglesey.

“The UK Government has increased Wales’ fiscal flexibilities – this will give Wales a more durable financial settlement, supporting Welsh public services and economic growth and recognises the ambitions in the UK Government’s manifesto commitment.

“Last year these additional flexibilities meant we were able to provide thousands of additional treatments in the NHS in Wales.”

Secretary of State for Wales, Jo Stevens MP, said: “People across Wales will have more money in their pockets as a result of our measures to help with the cost of living, another increase to the minimum and living wage and the removal of the two-child benefit cap.

“Once again there is a significant boost for the Welsh Government to spend on their priorities like the NHS and schools and we are also giving them new powers to invest more in vital public services.”

Plaid Cymru leader, Rhun ap Iorwerth said: “This Budget makes one thing clear: Wales is being short-changed again.

“Nothing in these announcements changes the fundamental unfairness facing our nation.

“We have weaker fiscal powers than any other devolved nation, meaning less ability to invest in our economy, and the Treasury continues to withhold over £4 billion owed to Wales in transport funding.

“There was no action on increased National Insurance or Inheritance Tax costs which are pushing the Welsh public and private sectors to breaking point.

“We welcome the scrapping of the two-child cap – long overdue and something for which Plaid Cymru has campaigned for years – but Welsh families will still face sky-high energy bills and mounting costs after this Budget.

“On taxation, Labour’s pick-and-mix approach is dishonest and chaotic. Rather than targeting the wealthiest and the big banks through wealth taxes, Rachel Reeves has chosen to freeze income tax thresholds for those in work, a dishonest and unfair wait to raise further revenue.

“Weeks of U-turns, last-minute announcements, and mixed messages have left households and businesses confused, undermining confidence in the economy.

“People in Wales deserved a Budget that recognised decades of underinvestment and the pressures facing households.

“Instead, we see more of the same.”

The Welsh Government draft budget was published earlier this month.

Finance secretary Mark Drakeford brought forward a “roll-over” draft budget worth £27bn, broadly rising by about two per cent in line with inflation, in an effort to cut a deal with opposition parties in a bid to push the budget through.

Senedd mathematics means Labour need opposition support to vote through the budget ahead of next May’s elections.

A vote on the Welsh Government budget is expected to be held in the Senedd in January.

.png?width=209&height=140&crop=209:145,smart&quality=75)

Comments

This article has no comments yet. Be the first to leave a comment.